1. Industry operation in the first half of the year

The following is a brief introduction to the year of 2019 based on the statistical data of the machine tool industry enterprises above designated size (hereinafter referred to as the "regulated enterprises"), customs import and export data and the China Machine Tool Industry Association (hereinafter referred to as the "Association") key contact enterprises based on the National Bureau of Statistics of China. Operation of the machine tool industry in the first half of the year.

A regulated enterprise refers to an industrial legal person enterprise with an annual operating income of more than 20 million yuan. As of June 2019, there are 5547 companies in the machine tool industry, involving eight sub-sectors. Among them, 782 are metal cutting machine tools, 540 are metal forming machine tools, and 705 are measuring tools and measuring instruments. These three sub-industry companies account for 36.5% of the total. There are 1,840 abrasives in the industry, accounting for the largest proportion, accounting for 33.2%.

In June 2019, China Machine Tool Industry Association has 243 key contact enterprises, including 125 in the metal cutting machine tool industry, 26 in the metal forming machine tool industry, and 34 in the measuring tool industry. These three sub-sectors accounted for 76.1%. There are 23 abrasives, accounting for 9.5%. The overall sample of the association's key contact enterprises is small, and the proportion of emerging private enterprises is small, so there will be a certain difference with the statistical data of enterprises regulated by the National Bureau of Statistics.

The completion of the main economic indicators from January to June 2019 is as follows.

1 1. Operating income

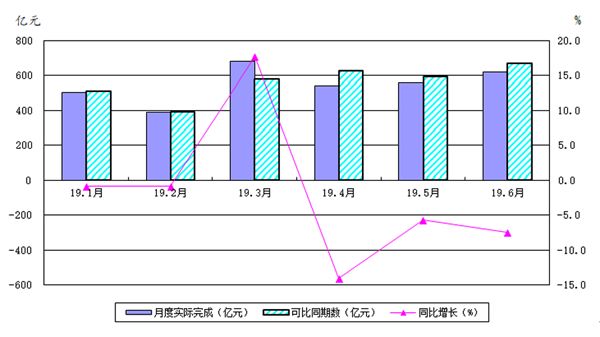

According to the statistical data of enterprises under the regulations of the National Bureau of Statistics, the cumulative operating income of the machine tool industry from January to June decreased by 2.3% year-on-year. Among them, the accumulated operating income of the metal cutting machine tool industry from January to June decreased by 15.4% year-on-year. The accumulated operating income of the metal forming machine tool industry from January to June decreased by 1.7% year-on-year. The cumulative operating income of the tools and measuring instruments industry from January to June decreased by 0.2% year-on-year.

图1 机床工具行业营业收入月度完成及同比变动情况(国统局)

The accumulated main business income of the key contact enterprises of the association from January to June decreased by 17.6% year-on-year. Among them, the accumulated main business income of the metal cutting machine tool industry decreased by 33.5% year-on-year. The accumulated main business income of the metal forming machine tool industry decreased by 2.6% year-on-year. The accumulated main business income of the measuring tool industry increased by 1.9% year-on-year.

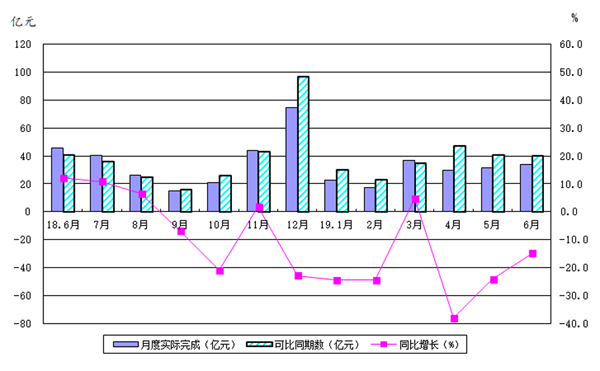

2. Total profit

According to the statistics of enterprises under the regulations of the National Bureau of Statistics, the total profit realized by the machine tool industry from January to June decreased by 20.9% year-on-year. Among them, the total profit realized by the metal cutting machine tool industry decreased by 67.8% year-on-year. The total profit realized by the metal forming machine tool industry decreased by 13.7% year-on-year. The total realized profits of the tools and measuring instruments industry decreased by 21.4% year-on-year.

图2 机床工具行业月度利润总额完成及同比增长情况(国统局)

The total profits realized by the key enterprises of the association from January to June decreased by 87.8% year-on-year. Among them, the total profit of the metal cutting machine tool industry was 1.21 billion yuan, compared with +480 million yuan in the same period last year. The total profit realized by the metal forming machine tool industry decreased by 17.6% year-on-year. The total realized profit of the measuring tool industry decreased by 12.4% year-on-year.

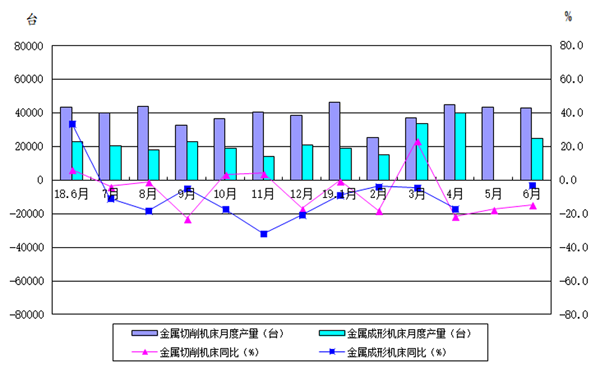

3. Output of metal processing machine tools

According to the statistical data of enterprises regulated by the National Bureau of Statistics, the machine tool industry accumulated from January to June, the output of metal cutting machine tools fell by 10.3% year-on-year, of which the output of CNC metal cutting machine tools fell by 24.4% year-on-year. The output of metal forming machine tools fell 5.1% year-on-year, of which the output of CNC metal forming machine tools fell 3.2% year-on-year.

The output of metal cutting machine tools from the key enterprises of the association from January to June fell by 29.4% year-on-year, of which the output of CNC metal-cutting machine tools fell by 30.6% year-on-year; the output of metal forming machine tools fell by 14.4% year-on-year, of which the output of CNC metal-forming machine tools fell by 1.9% year-on-year.

图3 金属加工机床月度产量及同比变动情况(国统局)

4. Proportion of loss-making companies

According to the statistical data of enterprises regulated by the National Bureau of Statistics, among the 5547 regulated enterprises in the machine tool industry, 1033 are loss-making enterprises, with a loss of 18.6%, an increase of 2.8 percentage points over the same period of the previous year. Among them, the metal cutting machine tool industry suffered the largest loss, at 27.7%, an increase of 7.4% over the same period last year.

The key association enterprises of the association accounted for 38.3% of loss-making enterprises in June, an increase of 10.3 percentage points year-on-year. Among them, the metal cutting machine tool industry accounted for 43.2%, an increase of 4.8 percentage points year-on-year; the metal forming machine tool industry accounted for 46.2%, an increase of 23.1 percentage points year-on-year.

5. Finished goods inventory

According to the statistical data of enterprises regulated by the National Bureau of Statistics, the inventory of finished products in the machine tool industry at the end of June increased by 3.4% year-on-year. Among them, the inventory of finished products in the metal cutting machine tool industry increased by 4.1% year-on-year. The inventory of finished products in the metal forming machine tool industry decreased by 3.3% year-on-year. The inventory of finished products in the tools and measuring instruments industry increased by 7.0% year-on-year.

The inventory of finished products of the key enterprises of the Association from January to June increased by 7.0% year-on-year. Among them, metal cutting machine tools increased by 3.3% year-on-year, and metal forming machine tools decreased by 12.3% year-on-year. The inventory of finished products of tools and tools increased by 17.1% year-on-year.

6. Metal processing machine tool orders

From January to June, new orders for metal processing machine tools from key enterprises of the association fell by 38.8% year-on-year, and orders in hand fell by 16.9% year-on-year. Among them, new orders for metal cutting machine tools fell 42.6% year-on-year, and orders in hand fell 15.6% year-on-year; new orders for metal forming machine tools fell 28.5% year-on-year, and orders in hand fell 19.7% year-on-year.

2. Import and export situation

According to data provided by China Customs, the total import volume of the machine tool industry from January to June 2019 was US$6.95 billion, a year-on-year decrease of 20.6%. Among them, metal cutting machine tool imports totaled US$3.03 billion, a year-on-year decrease of 31.5%; metal forming machine tool imports totaled US$790 million, a year-on-year decrease of 4.5%. From January to June 2019, the total export value of the machine tool industry was 7.03 billion US dollars, a year-on-year increase of 9.2%. Among them, the total export value of metal cutting machine tools was US$1.42 billion, a year-on-year increase of 12.1%; the total export value of metal forming machine tools was US$740 million, a year-on-year increase of 25.0%. (See Table 1 for details)

From January to June 2019, the import and export of the machine tool industry saw a surplus for the first time in history. From the data point of view, the main reason is the increase in exports and the decrease in imports. The increase in exports reflects the long-term efforts of the industry to actively explore the international market. The decrease in imports is mainly related to the decline in domestic demand, and there may also be other reasons. But at the same time, it should be noted that the situation in each sub-industry is different. The tool and abrasives industries are in surplus, while metal processing machine tools (including metal cutting machine tools and metal forming machine tools) are still in deficit.

1. Import situation

It can be seen from Table 2 and Table 3 that among the listed categories and varieties, only the imports of CNC devices have increased, and the rest have decreased. It shows that the demand for CNC devices for the automation and intelligent upgrading of my country's equipment manufacturing industry is growing rapidly.

2. Export situation

3. Main features of industry operation

1. Industry operation overall down

Statistics from the key enterprises contacted by the National Bureau of Statistics and the Association show that the operation of the machine tool industry in the first half of 2019 has generally shown a downward trend, and major economic indicators such as revenue, profit, output, and output value have all declined year-on-year. Among metal processing machine tools, the decline in the metal cutting machine tool industry's indicators is greater than that of the metal forming machine tool industry. The metal processing machine tool order data of the key contact enterprises of the association showed a year-on-year decline, and the rate of decline increased month by month, indicating that the metal processing machine tool industry will be under great pressure in the second half of the year.

One of the main reasons for the current downturn in the industry is that the growth rate of fixed asset investment has been too low in recent years. The downward pressure on the macro economy in the first half of this year has increased, and the decline in the major user sectors of industries such as automobiles, motorcycles, internal combustion engines, agricultural machinery, and general machinery manufacturing is also a direct factor that caused the machine tool industry to decline in the first half of the year.

On the other hand, the main economic indicators of the machine tool industry in 2019 started at a low point, and have been in a year-on-year decline from January to June, which is related to the base period data level. As a base period for comparison, the machine tool industry was in a relatively rapid growth range from January to April of 2018, with a slight decline in May and June, but it was still operating at a high level. The decline continued in the second half of 2018, and this trend continued into the first half of 2019.

2. Decline in industry operation quality

Statistics from the key enterprises contacted by the National Bureau of Statistics and the Association show that the total realized profits of the machine tool industry and major sub-sectors in the first half of 2019 have significantly decreased year-on-year, and the industry’s losses have increased. In particular, the decline in metal cutting machine tool sub-industry has been more serious.

3. Fluctuations in the import and export situation

From January to June this year, the entire machine tool industry and the metal cutting machine tool and metal forming machine tool sub-sectors have been showing a significant year-on-year increase in total exports and a sharp decline in total imports. In the context of Sino-US trade frictions, the export growth of the machine tool industry has become a highlight of the industry's operation in the first half of this year. The continued substantial decline in total imports may be related to various factors such as changes in domestic market demand.

4. Pre-judgment of the industry situation in the second half of 2019

From a macro perspective, the manufacturing purchasing managers' index in July was 49.7%, an increase of 0.3 percentage points from the previous month, and it was below the line of prosperity for three consecutive months. The Politburo meeting of the CPC Central Committee held on July 30 that my country’s current economic development is facing new risks and challenges, and the downward pressure on the domestic economy is increasing.

The automobile manufacturing industry is the largest market for machine tools. From January to June this year, the production and sales volume of the automobile manufacturing industry decreased by 13.7% and 12.4% respectively over the same period of the previous year. Automobile production and sales have been declining year-on-year for 12 consecutive months, and the full year of 2019 is expected to grow negatively. This will have a great impact on the market demand of the machine tool industry.

From January to June, the total investment in fixed assets of the society increased by 5.8% year-on-year, which was 0.2 percentage points faster than that from January to May. Among them, manufacturing investment increased by 3.0% year-on-year, 0.3 percentage points faster than January-May, and rebounded for two consecutive months. Investment in the automobile manufacturing industry increased by 0.2% year-on-year, from a year-on-year decline for three consecutive months to an increase.

Factors such as Sino-US trade frictions, rising trade protectionism, geopolitical conflicts, and financial risks have had a major negative impact on the global economy.

Based on the above situation, the downward pressure on the economic operation of the machine tool industry in the second half of the year has intensified, but there are also favorable factors such as the rebound of fixed asset investment in related industries, tax cuts and fees, lower corporate social security charges, and lower industrial electricity prices. In the second half of the year, the machine tool industry will continue to maintain a trend of continuous upgrades in demand, with obvious structural changes in demand, and a downward trend in total demand, with different performances in various sub-industry sectors. It is expected that the main economic indicators of the industry for the whole year will show great downward pressure year-on-year.

On July 30, the Politburo meeting of the CPC Central Committee pointed out that it is necessary to increase the awareness of crisis, grasp the long-term general trend, seize the main contradictions, be good at turning crises into opportunities, and run their own affairs well. This has important guiding significance for the machine tool industry to correctly study and judge the situation and do a good job in the second half of the year.