This report is based on the statistical data of enterprises in the machine tool industry above designated size by the National Bureau of Statistics (referring to industrial legal person enterprises with annual operating income of more than 20 million yuan, hereinafter referred to as "regulated enterprises"), customs import and export data and statistical data of key contact enterprises of the Association. , A brief analysis of the operation of the machine tool industry in the first three quarters of this year.

In September 2019, there were a total of 5624 companies in the machine tool industry, involving eight sub-sectors: metal cutting machine tools (accounting for 14.2%), metal forming machine tools (accounting for 9.7%), tools and measuring instruments (accounting for 12.7%), abrasives Abrasive tools (33.7%), machine tool functional parts and accessories (6.7%), foundry machinery (9.3%), wood and bamboo processing machinery (2.6%) and other metal processing machinery (11.1%).

In September 2019, the China Machine Tool Industry Association (hereinafter referred to as the "Association") has 243 key contact enterprises, of which three sub-sectors of metal cutting machine tools, metal forming machine tools, measuring tools and measuring instruments are the main body of the sample, accounting for a total of 76.1 %.

1. Industry operation from January to September

1. Operating income

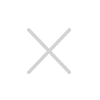

According to the statistical data of enterprises under the regulations of the National Bureau of Statistics, the cumulative operating income of the machine tool industry from January to September decreased by 0.9% year-on-year. Among them, the accumulated operating income of the metal cutting machine tool industry from January to September decreased by 13.9% year-on-year, the accumulated operating income of the metal forming machine tool industry from January to September decreased by 5.2% year-on-year, and the accumulated operating income of the tool and measuring instrument industry from January to September decreased year-on-year. An increase of 2.3%. Figure 1 shows the completion and year-on-year changes in operating income of the machine tool industry.

图1 机床工具行业营业收入完成及同比变动情况(国统局)

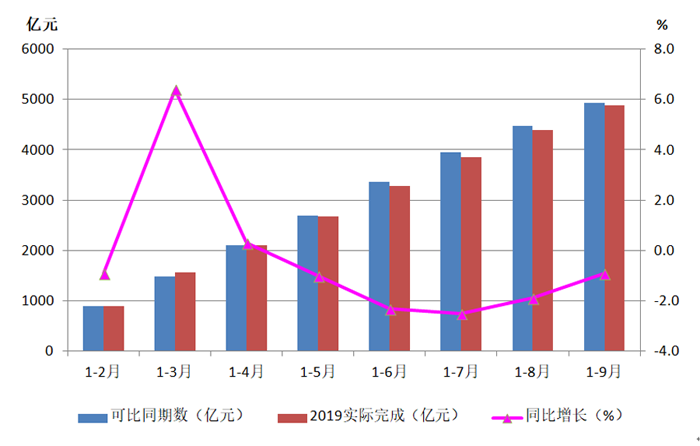

Figure 2 shows the comparison of the year-on-year change of operating income from January to September this year and the year-on-year change of main business income in 2018. It can be seen from the figure that after reaching a high of 14.6% in April 2018, it entered a volatile downward trend, but it still maintained a year-on-year growth of 8.3% at the end of the year. In 2019, except for the cumulative year-on-year growth in March and April, the subsequent months have been declining year-on-year, and the decline has slowed down after July. However, the downward pressure on the industry in the first three quarters of this year is more obvious than last year.

图2 机床工具行业营业收入同比变化(国统局)

From January to September, the accumulated main business income of the key contact enterprises of the association decreased by 14.7% year-on-year. Among them, the accumulated main business income of the metal cutting machine tool industry decreased by 30.8% year-on-year, the accumulated main business income of the metal forming machine tool industry decreased by 3.3% year-on-year, and the accumulated main business income of the tool and measuring instrument industry decreased by 0.5% year-on-year.

2. Total profit

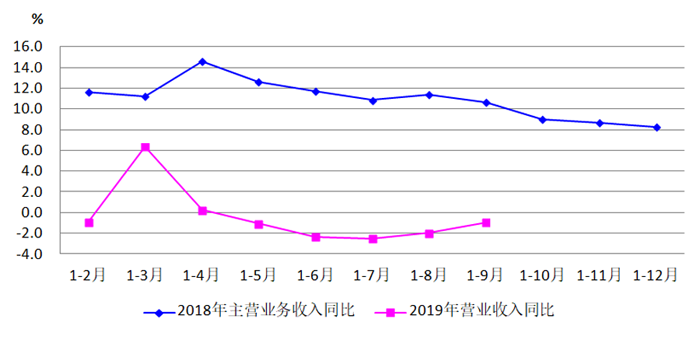

According to the statistical data of enterprises regulated by the National Bureau of Statistics, the total profit realized by the machine tool industry from January to September decreased by 18.4% year-on-year. Among them, the total realized profit of the metal cutting machine tool industry decreased by 67.5% year-on-year, the total realized profit of the metal forming machine tool industry decreased by 19.2% year-on-year, and the total realized profit of the tool and measuring instrument industry decreased by 15.1% year-on-year. Figure 3 shows the completion and year-on-year growth of the total profit of the machine tool industry.

图3 机床工具行业利润总额实现及同比变动情况(国统局)

From January to September 2019, key affiliates lost 130 million yuan in overall losses, compared with a profit of 3.83 billion yuan in the same period last year. The total profit of each sub-industry has dropped significantly year-on-year. Among them, the total profit of the metal cutting machine tool industry was a loss of 2.69 billion yuan in the current period and a loss of 100 million yuan in the same period last year; the total realized profit of the metal forming machine tool industry decreased by 18.0% year-on-year; the cumulative total profit realized by the tool and measuring instrument industry decreased by 8.7 year-on-year %.

3. Output of metal processing machine tools

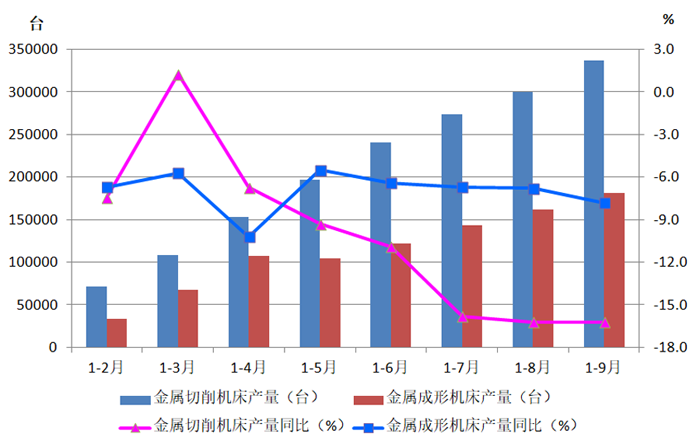

According to the statistical data of enterprises regulated by the National Bureau of Statistics, in the machine tool industry from January to September, the output of metal cutting machine tools fell 16.2% year-on-year, of which the output of CNC metal cutting machine tools fell 29.0% year-on-year. The output of metal forming machine tools fell by 7.8% year-on-year, of which the output of CNC metal forming machine tools fell by 7.0% year-on-year.

From January to September, the output of metal cutting machine tools from the key enterprises of the association fell by 27.5% year-on-year, of which the output of CNC metal cutting machine tools fell 31.8% year-on-year; the output of metal forming machine tools fell 17.5% year-on-year, of which the output of CNC metal forming machine tools fell 2.2% year-on-year. See Figure 4 for details of metal processing machine tool output and year-on-year changes.

图4 机床工具行业金属加工机床产量及同比变动情况(国统局)

4. Proportion of loss-making companies

According to statistics from the National Bureau of Statistics, among the 5624 regulated companies in the machine tool industry, 994 were loss-making companies in September, with a loss of 17.7%. Among them, the metal cutting machine tool industry has the largest loss, accounting for 29.0%; the metal forming machine tool industry is 21.8%.

The key association enterprises of the association accounted for 37.9% of loss-making enterprises in September. Among them, the metal cutting machine tool industry has the largest loss, accounting for 47.2%; the metal forming machine tool industry is 30.8%.

5. Finished goods inventory

According to the statistics of enterprises under the regulations of the National Bureau of Statistics, the inventory of finished products in the machine tool industry at the end of September increased by 3.5% year-on-year. Among them, the inventory of finished products in the metal cutting machine tool industry increased by 6.5% year-on-year, the inventory of finished products in the metal forming machine tool industry decreased by 7.5% year-on-year, and the inventory of finished products in the tool and measuring instrument industry decreased by 0.2% year-on-year.

At the end of September, the inventory of finished products of the key association enterprises of the association increased by 5.0% year-on-year. Among them, the inventory of finished metal cutting machine tools increased by 0.6% year-on-year, the inventory of finished metal forming machine tools decreased by 5.5% year-on-year, and the inventory of finished tools and tools increased by 14.3% year-on-year.

6. Metal processing machine tool orders

From January to September, new orders for metal processing machine tools from key associations of the association fell by 33.3% year-on-year, and orders in hand fell by 22.8% year-on-year. Among them, new orders for metal cutting machine tools fell 36.7% year-on-year, and orders in hand fell 22.6% year-on-year; new orders for metal forming machine tools fell 23.9% year-on-year, and orders in hand fell 23.3% year-on-year.

2. Import and export situation

1. Overall situation

According to data provided by China Customs, the total import volume of the machine tool industry from January to September 2019 was US$10.27 billion, a year-on-year decrease of 20.9%. Among them, metal cutting machine tool imports totaled US$4.5 billion, a year-on-year decrease of 30.6%; metal forming machine tool imports totaled US$1.18 billion, a year-on-year decrease of 2.7%. From January to September 2019, the total export value of the machine tool industry was US$10.65 billion, a year-on-year increase of 6.5%. Among them, the total export value of metal cutting machine tools was US$2.14 billion, a year-on-year increase of 9.1%; the total export value of metal forming machine tools was US$1.1 billion, a year-on-year increase of 16.5% (see Table 1 for details).

Table 1 Import and export situation of machine tool industry and some product categories from January to September 2019

序号 | 项 目 | 进口金额 (亿美元) | 同比(%) | 出口金额 (亿美元) | 同比(%) |

1 | 机床工具总计 | 102.7 | -20.9 | 106.5 | 6.5 |

2 | 金属切削机床 | 45.0 | -30.6 | 21.4 | 9.1 |

3 | 金属成形机床 | 11.8 | -2.7 | 11.0 | 16.5 |

4 | 机床功能部件(含零件) | 11.9 | -23.7 | 9.1 | -5.7 |

5 | 数控装置 | 11.2 | -0.2 | 8.4 | 12.1 |

6 | 切削刀具 | 12.3 | -4.6 | 22.0 | 2.3 |

7 | 量具量仪 | 1.5 | -13.6 | 1.4 | -8.5 |

8 | 磨料磨具 | 4.4 | -22.2 | 18.7 | -0.5 |

2. The top five varieties of metal processing machine tools in terms of import and export value

表2 进口金额排前五位的金属加工机床品种

排名 | 金属加工机床品种 | 进口金额 (亿美元) | 占比(%) | 同比(%) |

1 | 加工中心 | 16.8 | 29.6 | -41.8 |

2 | 磨床 | 7.6 | 13.3 | -19.6 |

3 | 特种加工机床 | 7.2 | 12.7 | -28.1 |

4 | 车床 | 5.1 | 9.0 | -16.3 |

5 | 其他金属成形机床 | 3.0 | 5.3 | -5.4 |

It can be seen from Table 2 that the top five imported varieties all dropped significantly year-on-year, and the import amount and proportion of processing centers still ranked first, but the year-on-year decline was as high as 41.8%.

表3 出口金额排前5名的金属加工机床品种

排名 | 金属加工机床品种 | 出口金额 (亿美元) | 占比(%) | 同比(%) |

1 | 特种加工机床 | 8.2 | 25.4 | 10.6 |

2 | 车床 | 3.8 | 12.0 | -13.1 |

3 | 其他金属成形机床 | 3.6 | 11.2 | 19.8 |

4 | 成形折弯机 | 2.5 | 7.8 | 10.4 |

5 | 加工中心 | 1.9 | 5.7 | 30.6 |

It can be seen from Table 3 that, except for lathes, the top five export varieties all increased significantly year-on-year. It is worth noting that the export growth of processing centers was as high as 30.6% year-on-year, which is in sharp contrast to the sharp decline in imports.

3. Main features of industry operation

1. Industry operation overall down

Statistics from the key enterprises contacted by the National Bureau of Statistics and the Association show that the operation of the machine tool industry in the first three quarters of 2019 has generally shown a downward trend, and major economic indicators such as revenue, profit, output, and output value have all declined year-on-year. Among metal processing machine tools, the decline in the metal cutting machine tool industry's indicators is greater than that of the metal forming machine tool industry. The metal processing machine tool order data of the key contact enterprises of the association also decreased year-on-year.

One of the main reasons for the current downturn in the industry is the recent continuous decline in the growth rate of fixed asset investment. The continuous decline of major user areas in industries such as automobiles, motorcycles, 3C, internal combustion engines, agricultural machinery, and general machinery manufacturing is also a direct factor that has caused the deep down of the machine tool industry this year.

2. Decline in industry operation quality

Statistics from the key enterprises contacted by the National Bureau of Statistics and the Association show that in the first three quarters of 2019, the total profit realized by the machine tool industry and major sub-sectors has decreased significantly year-on-year, and the industry's losses have increased. In particular, the decline in metal cutting machine tools by industry has been more serious, and some companies have difficulty operating.

3. Fluctuations in the import and export situation

In the first three quarters of this year, full-caliber machine tools, metal cutting machine tools and metal forming machine tools have been showing a significant year-on-year increase in exports, while imports have fallen sharply year-on-year. Following the first surplus in import and export history in the first half of this year, the third quarter continued to maintain a surplus. In the context of Sino-US trade frictions, the export growth of the machine tool industry has become a prominent feature of the industry's operation in the first three quarters of this year.

The main reason for the surplus is the increase in exports and the decrease in imports. The increase in exports reflects the long-term efforts of the industry to actively explore the international market. The decrease in imports is mainly related to the decline in domestic demand and other reasons. But at the same time, it should be noted that the situation of each sub-industry is different. The cutting tool and abrasives industries are in surplus, while metal cutting machine tools, metal forming machine tools, machine tool functional components (including parts) and numerical control devices are still in deficit, but metal forming machine tools and Imports of numerical control devices have fallen, while exports have achieved double-digit growth, and are approaching the balance of imports and exports.

4. The machine tool market presents a notable characteristic of adjusting and upgrading the demand structure. Accompanying this is the breakdown of the industry structure balance, the obvious differentiation of enterprises, and the in-depth adjustment of the industry structure.

4. Pre-judgment of the industry situation in 2019

From a macro perspective, the year-on-year GDP growth rate of GDP continued to decline, and the year-on-year GDP growth rate in the first three quarters of this year was 6.2%. In October, the National Bureau of Statistics Manufacturing Purchasing Managers Index PMI was 49.3%, which was below the line of prosperity for six consecutive months. From January to September, the investment in fixed assets of the whole society increased by 5.4% year-on-year, of which investment in the manufacturing industry increased by 2.5% year-on-year. As the main user industry of machine tool products, the investment in the automobile manufacturing industry increased by 1.8% year-on-year. The growth rate of investment in manufacturing and automobile manufacturing is significantly lower than the growth rate of investment in the whole society.

As the largest market for machine tools, the automobile manufacturing industry has been in continuous decline for 15 months year-on-year. The cumulative production and sales volume of automobiles from January to September this year decreased by 11.4% and 10.3% respectively compared with the same period of the previous year, which will have a great impact on the market demand of the machine tool industry.

From the external situation, other major machine tool producing countries and regions have also experienced a serious decline this year. For example, the total orders of the German machine tool industry in the second quarter of this year decreased by 22% year-on-year; the total orders of the US machine tool industry from January to August decreased by 14% year-on-year; the total orders of the Japanese machine tool industry from January to August decreased by 30.6% year-on-year; Taiwan, China, from January to September this year The monthly export value of machine tools fell by 14.2% year-on-year, of which exports to mainland China fell by 24.2%. In 2018, global machine tool consumption increased by 4.8%, and most of the major machine tool producing countries achieved considerable growth, but since 2019, they have generally encountered downward pressure on the market. The rise of international trade protectionism and Sino-US trade frictions have had a significant negative impact on the global machine tool market.

Based on the above situation, the continued downward trend of the machine tool industry may be difficult to reverse in the short term. It is expected that the main economic indicators of the industry for the whole year will show a year-on-year downward trend, but each sub-industry will have different performances.